Special Offers

We know you work hard for your money.

Our advice, great rates, and special offers can help make your money go further and work hard for you.

Conveniently available during Contact Centre hours.

Click on the Chat icon on the bottom right to get started.

Plus up to $600 in chequing account rewards and more.

We have the tools and support you need to achieve your dreams and secure your financial future.

2024 Annual General Meeting - April 25th

Registration Now Open

Explore our products & services

We know you work hard for your money.

Our advice, great rates, and special offers can help make your money go further and work hard for you.

We care about your financial well-being

Members First

Everyday, we work hard to bring you the financial products and services you need.

Digital Banking Support

Do your banking without stepping foot into a branch. Check out our videos and guides to get the most out of your digital banking experience.

Personalized Advice

We offer advice tailored for your life, to improve your financial well-being.

Our current mortgage rates

5-yr fixed closed –

high ratio

interest rate APR

5-year variable closed – high ratio

interest rate APR

5-yr variable

closed

interest rate APR

*rates subject to change

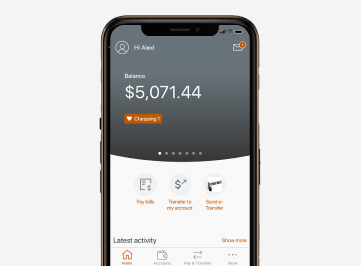

Open an Alterna Savings bank account today and get free access to all these great digital banking features.

How can we help?

At Alterna, our members always come before profits. Connect today and learn how we put the good in banking.

Bank 24/7 from the comfort of your home or on the go with Alterna’s online banking and mobile app.

Financial guidance to help with navigating your changing life. Explore topics and build your financial know-how.

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.

Stay in touch. Be the first to know about news, promotions and announcements. Signup Now!