Investing

Canadian Index Guaranteed Return

Investing

Canadian Index Guaranteed Return

Alterna’s MarketTracer® Term Deposit - Canadian Index Guaranteed Return is similar to a regular term deposit, but the return is based on the performance of the S&P/TSX60 index. That means you can participate in the performance of the Canadian stock market while guaranteeing 100% of your principal investment, as well as earning a guaranteed minimum return.

For more information on the Alterna MarketTracer® Term Deposit - Canadian Index Guaranteed Return, contact us.

Product Information

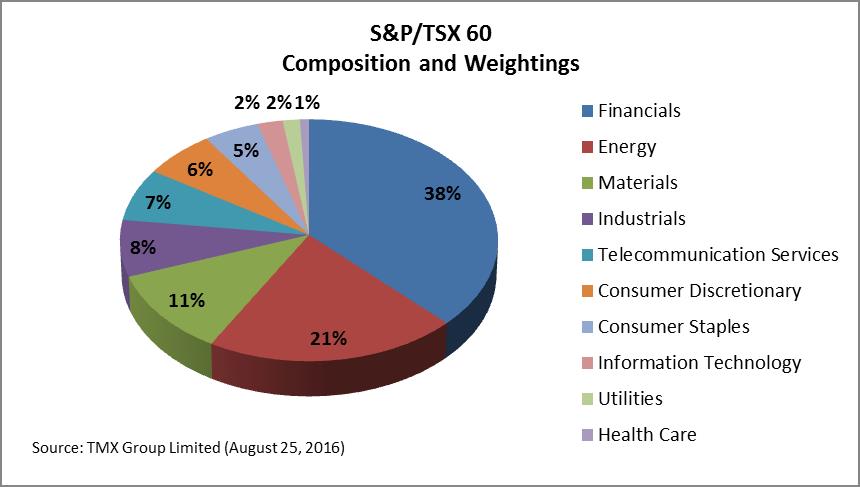

The S&P/TSX60 index is the most widely traded equity index in Canada.

Alterna’s MarketTracer® Term Deposit – Canadian Index Guaranteed Return at a glance | |||||||||

|---|---|---|---|---|---|---|---|---|---|

Sales Period: | Currently unavailable | ||||||||

Index | S&P/TSX60 | ||||||||

Term (non-redeemable) | 5 Year | ||||||||

Minimum Investment | $500 | ||||||||

Principal Guaranteed | Yes | ||||||||

Guaranteed Annual Return | 1.60%* | ||||||||

Guaranteed Cumulative Appreciation | 8.00%* | ||||||||

Maximum Cumulative Appreciation | 16.00%* | ||||||||

Market Participation | 100% or higher depending on the issue | ||||||||

Plan Eligibility | RRSP and TFSA | ||||||||

Alterna’s MarketTracer® Term Deposit - Canadian Index Guaranteed Return is right for you if you:

Fact Sheet & Performance

Canadian Index Guaranteed Return MarketTracer Past Performance (PDF)

The S&P/TSX60 Index is made up of 60 of the largest publicly traded, blue chip companies in Canada. Their stock values are tracked daily and reflected in the index, which acts as an indicator of market performance.

Benefits

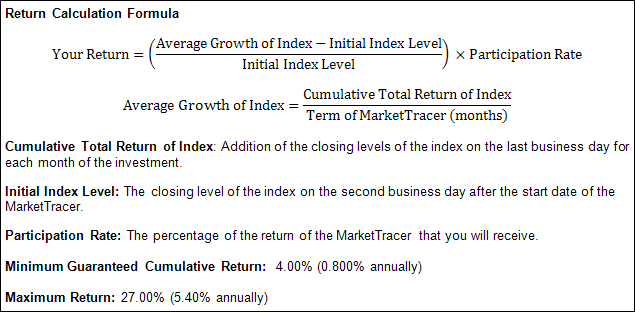

Return Calculation and Example

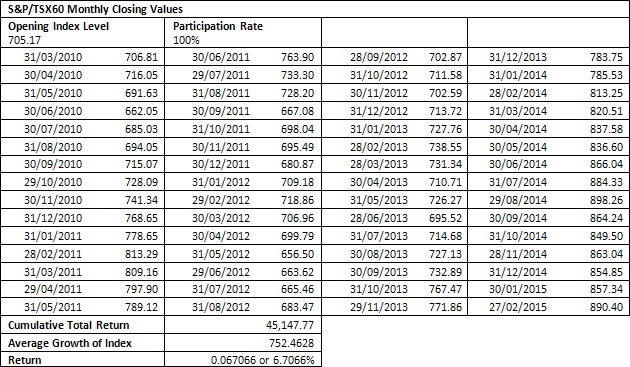

Example of Return Calculation (5-Year Term)*

* This example calculation is for informational purposes only and has no relation to future performance. The maximum return for this MarketTracer is 27.00%. If the return at maturity exceeds 27.00%, the final interest paid will be 27.00%.

Definitions:

Interest Paid: the interest paid will be based on a percentage (Gross up) of the average monthly growth of the S&P/TSX 60 Index over the term of the deposit.

Index: S&P/TSX 60 Index

Arithmetic Average: Means the sum of the stock price index value of an Index on each of the Valuation Dates between the Index Set Date and the Maturity Date, divided by the number of Valuation Dates.

Index Set Date: The date on which the starting value of the Index is established.

Participation Rate: Leverage ratio by which the percentage growth of the Index (as per the averaging formula) is multiplied.

Index Business Day: Means any day on which commercial banks are open for business in Toronto and is (or, but for the occurrence of a Market Disruption Event, would have been) a trading day on the Toronto Stock Exchange and the Related Exchange, other than a day on which trading on the Toronto Stock Exchange or the Related Exchange is scheduled to close prior to its regular weekday closing time.

Valuation Time: At the close of trading on the related stock exchange.

Valuation Date: Means the close of trading on the last Index Business Day of each calendar month

S&P® and TSX™ are registered trademarks of Standard & Poor’s Financial Services LLC and the Toronto Stock Exchange and have been licensed for use by Alterna Savings. The product is not sponsored, endorsed, sold or promoted by Standard & Poor’s or the Toronto Stock exchange and neither Standard & Poor’s nor the Exchange Partner makes any representation regarding the advisability of investing in the Product.

Alterna refers to both Alterna Savings and Credit Union Limited (operating as Alterna Savings) and CS Alterna Bank (operating as Alterna Bank). Alterna Bank is a wholly-owned subsidiary of Alterna Savings.

Alterna Savings is a member of the Deposit Insurance Corporation of Ontario.

8.00% refers to the minimum cumulative return of the 5 year term (1.60% guaranteed annual return). 16% refers to the maximum cumulative return possible on the five year term. Minimum investment $500. Rate subject to change without notice. See in branch for details.

At Alterna Savings, eligible deposits in registered accounts have unlimited coverage through the Financial Services Regulatory Authority (FSRA). Eligible deposits (not in registered accounts) are insured up to $250,000 through the Financial Services Regulatory Authority (FSRA).

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.

Stay in touch. Be the first to know about news, promotions and announcements. Signup Now!