Borrowing

Overview

Borrowing

Overview

A variety of options to fit your every need.

Whether you’re looking to renovate your home, buy a new car or cover the cost of a much-deserved vacation, we can help you achieve your plans and dreams. We offer competitive rates on a variety of loans, lines of credit* and credit cards, so you can find the right solution for your specific needs.

Choose the option that's right for you

Personal Loan

A flexible loan for a major purchase like a home reno or a car.

Features and Benefits:

Investment Loan

A lump sum to help you maximize your RRSP contributions.

Features and Benefits:

Outdoor Adventure Loan

Flexible financing to buy an RV, motor home or trailer.

Features and Benefits:

Personal Line of Credit

Access funds quickly and only pay interest on what you borrow.

Features and Benefits:

Secured Line of Credit

Leverage your home equity to access funds at a lower rate.

Features and Benefits:

Student Line of Credit

An easy solution to help cover tuition, books and rent.

Features and benefits:

Investment Line of Credit

A line of credit to buy investments through Alterna or Qtrade.

Features and benefits:

Contact us today and we can help you pick the right option for your needs.

or call us at 1.877.560.0100

Loan Calculator

Use our Loan Calculator to help determine how much you can borrow and what your repayment schedule might be.

Articles

Understanding the Key Factors of a Good Credit Score and Its Importance

Understanding the factors that contribute to a good credit score and why it is essential is paramount for financial well-being.

Are you getting the most out of your credit card? These tips can help enjoy the perks while avoiding hefty interest charges.

A line of credit acts as a preset borrowing limit. It provides you with the flexibility to access extra money quickly when you need it.

Frequently Asked Questions

You've got questions.

We've got answers.

Frequently Asked Questions

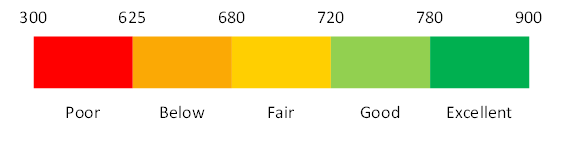

In Canada, credit scores typically range from 300 to 900, with higher scores indicating better creditworthiness. This score is generated based on various factors related to your credit history and financial behaviour. It serves as a measure of how likely you are to repay borrowed money responsibly. Lenders, landlords, and even employers may use your credit score to assess your reliability and trustworthiness.

Lenders use various factors to calculate credit scores that could include:

There are several types of credit scores available. Typically, the higher the score the better. A higher credit score makes it easier to qualify for loans and credit cards, often with more favorable terms, such as lower interest rates. Monitoring your credit score is important for financial planning and managing your overall credit health.

Improving your credit score takes time and consistent effort. Here are some steps you can take to boost your credit score:

Check your credit report: Obtain a copy of your credit report from each of the major credit bureaus (Equifax and TransUnion). Review the reports for any errors or inaccuracies. Dispute any discrepancies you find.

Pay your bills on time: Timely payment of your bills, including credit cards, loans, and utilities, is crucial for a good credit score.

Reduce outstanding debt: Aim to lower your credit card balances and other outstanding debts.

Diversify your credit mix: Having a mix of different types of credit, such as credit cards, installment loans, and a mortgage, can positively impact your credit score.

Be patient: Improving your credit score is a gradual process. It takes time to establish a positive credit history and demonstrate responsible financial behavior.

Seek professional advice if needed: If you're facing significant credit challenges, consider consulting with a credit counselor or financial advisor for personalized guidance. Remember, consistent and responsible financial habits are key to improving and maintaining a good credit score. It's essential to be patient and persistent in your efforts.

To Access Better Loan Terms

Whether you’re buying a home, financing a car, or seeking a personal loan, a good credit score can lead to lower interest rates and more favourable terms. This can translate into significant savings over the life of the loan.

Rental Accommodations

Landlords often review credit scores as part of the tenant screening process. A good credit score can enhance your chances of securing desirable rental accommodations.

Employment Opportunities

Some employers may review credit reports as part of the hiring process, especially for positions involving financial responsibility or access to sensitive information. A good credit score can bolster your credibility as a candidate.

Utility Services

Providers may check your credit score when setting up utility services such as electricity, gas, or internet. A higher score may lead to better terms. Cell phone companies may also use credit bureau inquiries to determine if you are eligible for monthly billing or restrict you to pay-as-you-go plans.

Building Financial Security

Ultimately, a good credit score is an asset that opens doors to financial opportunities and stability. It allows you to qualify for better financial products and confidently navigate life’s milestones.

There are two main credit bureaus in Canada:

You can request a copy of your credit report from either bureau.

Credit Bureau agencies will allow you request your personal credit report for free and with no impact to your scores. In fact, reviewing your credit report regularly can help you to ensure that the information the credit reporting companies share with lenders is accurate and up-to-date.

A hard check generally occurs when a financial institution, such as a lender or credit card issuer, checks your credit when making a lending decision. They commonly take place when you apply for a mortgage, loan or credit card, and you typically have to authorize them.

A hard inquiry could lower your credit score. In most cases, a single hard inquiry is unlikely to play a huge role in whether you’re approved for a new card or loan.

A soft check typically occurs when a person or company checks your credit as part of a background check. This may occur, for example, when a credit card issuer checks to see if you qualify for certain credit card offers. Your employer might also run a soft inquiry before hiring you.

Unlike hard inquiries, soft inquiries won’t affect your credit scores.

You may also need...

Credit Cards

We have a credit card to fit your lifestyle. Whether you’re looking for valuable reward points, unique partner benefits or simply lower fees, you can choose the card that's right for you.

Investment Overview

Long Term savings. Short Term. Fixed. There are so many ways to invest and save, it can seem overwhelming. No need to stress, we’re here to help.

Mortgage

Whether you’re looking to buy a home, searching for a better mortgage rate or renew an existing mortgage, we have the right solution for your particular needs.

Chequing Account

Find a smarter way to make your money work for you. Alterna has a banking package to suit your every need.

Creditor Insurance

Protect your loved ones and gain peace of mind. Our payment protection† benefit ensures your financial obligations will be met if you experience disability, critical illness or job loss, or in the event of your death.

Creditor insurance is available for the following products in the event of death, disability, and critical illness:

Furthermore, creditor insurance is also available for the following products in the event of job loss:

How can we help?

*Approval and credit limit are subject to Alterna’s credit approval criteria.

†Payment Protection Legal Disclaimer:

Creditor’s group insurance coverage is optional and is underwritten by Co-operators Life Insurance Company. Supporting services, such as enrollment intake, medical underwriting and claims administration are provided by the employees of CUMIS Services Incorporated. Coverage is governed by the terms and conditions of the creditor’s group insurance policy issued to the creditor and is subject to terms, conditions, exclusions and eligibility requirements. See the Product Guide and Certificate of Insurance for full coverage details.

Your financial well-being comes first

Welcome to a better way to bank. Our knowledgeable team puts your financial well-being first with good, caring and transparent advice while offering all the products and services you need.

Stay in touch. Be the first to know about news, promotions and announcements. Signup Now!